Content

However, one financial ratio by itself does not provide enough information about the company. When considering debt, looking at the company’s cash flow is also important.

Whether you are an individual or small business, this concept applies to both. A low ratio is less than 36% (0.36) with a mortgage or 10% (0.1) without a mortgage. See how much money you can save with our debt settlement program. In fact, you can start getting out of debt TODAY through a 5-step system I’ve developed. After all, being in debt is the #1 barrier to living a Rich Life, and not only is it a financial burden, but it can also be a HUGE psychological burden as well. Perhaps you are interested in clean energy and automobiles, and you are inspired to consider investing in Tesla.

Example of Debt to Total Assets Ratio

With all the monthly data neatly together, he adds the long-term debt, bank loans, and wages payable to get a total liability of $43,000. He writes this number at the top of the asset to debt ratio equation.

- Most lenders hesitate to lend to someone with a debt to equity/asset ratio over 40%.

- Perhaps 46.5% isn’t so bad after all when you consider that the industry average was about 75% in 2022.

- For this long-term debt ratio equation, we use the total long-term debt of the company.

- Total shareholders equity represents the net worth of the company.

- Many companies leverage a large amount of debt to create strong, long-term growth—and investors who buy in early could potentially reap high, above-the-market returns.

- Long-term debt to assets ratio formula is calculated by dividing long term debt by total assets.

Property, plants, and equipment (PP&E) as part of the total assets. This is also a valid method to calculate the debt to asset ratio. Some of the biggest companies in the world have low debt ratios, including Apple and Google. In those cases, they are swimming in cash and have no reason to go deep into debt. Having a higher-than-average debt ratio is something to watch out for because it means the company could be over-leveraged — i.e., it has too much debt.

How to Calculate Debt to Asset Ratio

In the Duke and Southern Utility example, we can see that Duke reduced its LT debt ratio while Southern increased its. Looking at the numbers closer, we see that Southern has been adding debt to its books to grow its operations. https://www.bookstime.com/ If this strategy works, it could create long-term value for investors. High D/A ratios will also mean that the company will be forced to make more interest payments on its debt before net earnings are calculated.

- Alternatively, a low debt to asset ratio indicates that the company is in strong financial standing because they have fewer liabilities and more total assets.

- It is a great tool to assess how much debt the company uses to grow its assets.

- The debt to asset ratio is commonly used by analysts, investors, and creditors to determine the overall risk of a company.

- Check out the chart below to find out the average debt to asset ratio in a few different industries.

- Since the formulas are used in business, the terms remain the same in personal finance where your total assets are value of everything you own.

- It tells you the percentage of a company’s total assets that were financed by creditors.

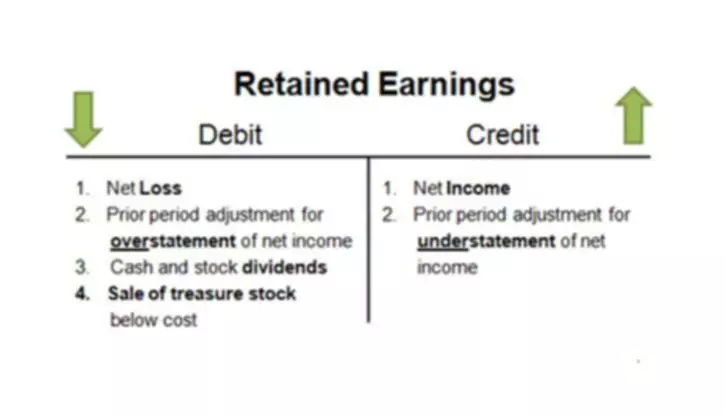

For example, the debt ratio for a business with $10,000,000 in assets and $2,000,000 in liabilities would be 0.2. This means that 20 percent of the company’s assets are financed through debt. The total debt service ratio is a debt-to-income metric that lenders use to determine whether to extend debt to asset ratio credit, primarily in the mortgage industry. From a pure risk perspective, lower ratios (0.4 or lower) are considered better debt ratios. Since the interest on a debt must be paid regardless of business profitability, too much debt may compromise the entire operation if cash flow dries up.

What is a Good Debt-to-Income Ratio?

To begin any math problem, big or small, the first step is reviewing the equation at hand. For the debt to asset ratio, the equation is on the easier side. The debt-to-asset ratio can be useful for larger businesses that are looking for potential investors or are considering applying for a loan. The obvious limitation of a debt ratio is that it does not provide any indication of asset quality because it uses all types of assets and liabilities combined together. Hence, benchmarking is an essential part of ratio analysis, where you compare companies of a similar size and business model in the same industry.

- This places your business in a precarious situation and will likely be viewed as a high-risk situation by investors or financial institutions.

- Companies with a higher ratio are more leveraged and, hence, riskier to invest in and provide loans to.

- The higher the ratio, the higher the interest payments and less liquidity.

- Lindsay was inspired to start writing about personal finance after seeing how much good financial management impacted her life in getting out of six-figure debt.

- Many investors prefer to buy into companies that have a low debt-to-equity ratio.

In other words, it measures the percentage of assets that a business would need to liquidate to pay off its long-term debt. The debt-to-equity ratio measures how much debt a company is using to finance its operations. A higher debt-to-equity ratio indicates that a company has higher debt, while a lower debt-to-equity ratio signals fewer debts.

The 16 Best Passive Income Investments In 2022

As always, thank you for taking the time to read today’s post, and I hope you find some value in your investing journey. If I can be of any further assistance, please don’t hesitate to reach out. With that, we will wrap up our discussion on the debt to asset ratio. Let’s look at a few companies from unrelated industries to understand how the ratio works to put this into practice. Consider that a company with a high amount of leverage or debt may run into trouble during times of stress, such as the recent market downturn in March 2020. Studying the debt situation for any company needs to be part of your process. The company must also hire and train employees in an industry with exceptionally high employee turnover, adhere to food safety regulations for its more than 17,133 stores in 2022.

“All of these combined with the debt ratio provide a more complete picture of the company’s financial health,” says Custovic. For example, according to the balance sheet for the Columbia outdoor clothing company, it had $385,095 in total debt, and $3,067,128 in total assets for the last quarter of 2021.

What is Your Risk Tolerance?

The debt to assets ratio (D/A) is a leverage ratio used to determine how much debt a company has on its balance sheet relative to total assets. This ratio examines the percent of the company that is financed by debt. If a company’s debt to assets ratio was 60 percent, this would mean that the company is backed 60 percent by long term and current portion debt. Debt to asset, also known as total debt to total asset, is a ratio that indicates how much leverage a company can use by comparing its total debts to its total assets.

Is a higher asset to equity ratio better?

There is no ideal asset/equity ratio value but it is valuable in comparing to similar businesses. A relatively high ratio (indicating lots of assets and very little equity) may indicate the company has taken on substantial debt merely to remain its business.

Essentially, it points out the way in which a company has grown and developed over time when it comes to acquiring assets. Keep in mind that this ratio should be used with several other leverage ratios in order to get a proper understanding of the financial riskiness of a company. Some of other relevant ratios that you can use are the Total debt to total assets ratio, Total debt to Equity ratio, and the LT debt to Equity ratio. As a rule of thumb, investors and creditors often look for a company that has less than 0.5 of debt to asset ratio.